Rönesans Gayrimenkul Yatırım A.Ş. (RGY) is the commercial real estate development and investment company of Rönesans Holding. By combining the group’s more than 30 years of construction experience with its 22 years of real estate experience, the company has become Turkey’s largest shopping center investment group in terms of 1.500.000 sqm construction area and 740.000 sqm gross leasable area.

The current portfolio includes 21 real estate in total, consisting 12 shopping centers, 4 offices, 1 residence, 1 school that already operational and 1 ongoing residence project and 2 land plots available for future development.

İPEK ILICAK KAYAALP

Chairperson of the Board

KAMİL YANIKÖMEROĞLU

Vice Chairman of the Board

ÖZGÜR CANBAŞ

Member of the Board

of Directors

SERCAN YÜKSEL

Member of the Board

of Directors

EBRU DİLDAR EDİN

Independent Member of

the Board of Directors

DERAN TAŞKIRAN

Independent Member of

the Board of Directors

Corporate Governance Committee

Duties and Working Principles of the Corporate Governance Committee - Click here to view.

Deran Taşkıran / Chair

Betül Ebru Edin / Member

Özgür Canbaş / Member

Ömer Sinan Tekol / Member

Audit Committee

Duties and Working Principles of the Audit Committee - Click here to view.

Betül Ebru Edin / Chair

Deran Taşkıran / Member

Early Detection of Risk Committee

Duties and Working Principles of the Early Detection of Risk Commitee - Click here to view.

Betül Ebru Edin / Chair

Deran Taşkıran / Member

Özgür Canbaş / Member

Sercan Yüksel / Member

The capital of the Company consists of (i) 297,642,550 A group shares with a value of 297,642,550.00.-TL and (ii) 33,357,450 B group shares with a value of 33,357,450.00.-TL. A group shares have the privilege of nominating candidates to the board of directors as specified in the articles of association. A group shares also have the privilege of nominating the chairman and vice chairman of the board of directors. B group shares do not have any privileges.

| Article | Registration Date of the Announcement | Date of Announcement on the Trade Registry Gazette | Trade Registry Gazette No |

| - (Registration of Articles of Association) | 02.06.2006 | 07.06.2006 | 6572 |

| 16,17 | 12.06.2007 | 15.06.2007 | 6831 |

| 7 | 24.12.2007 | 27.12.2007 | 6965 |

| 5 | 24.01.2008 | 29.01.2008 | 6987 |

| 7 | 28.02.2008 | 04.03.2008 | 7012 |

| 7 | 30.06.2008 | 03.07.2008 | 7097 |

| 7 | 23.11.2009 | 26.11.2009 | 7447 |

| 5,19 | 31.05.2010 | 03.06.2010 | 7577 |

| 11, 16, 17 | 09.06.2010 | 14.06.2010 | 7584 |

| 7 | 14.12.2010 | 17.12.2010 | 7710 |

| 3, 5-13, 15-19, 21-28, 30- 34 | 26.01.2011 | 31.01.2011 | 7741 |

| 3, 5, 7, 8,11, 19, 22, 25, 27, 30, 31, 32, 33, 35 | 10.05.2012 | 15.05.2012 | 8068 |

| 11 | 04.10.2012 | 09.10.2012 | 8170 |

| 3, 6, 11-13, 15, 16, 18, 19, 22, 24, 27, 28, 30 | 22.05.2013 | 27.05.2013 | 8328 |

| 7 | 27.12.2013 | 02.01.2014 | 8477 |

| 11 | 31.01.2014 | 06.02.2014 | 8502 |

| 5, 7, 8, 11-13, 15-18, 21, 22, 28 | 09.12.2014 | 12.12.2014 | 8714 |

| 7 | 25.02.2015 | 02.03.2015 | 8769 |

| 11 | 16.04.2018 | 19.04.2018 | 9562 |

| 4 | 24.02.2020 | 26.02.2020 | 10024 |

| 11 | 02.10.2020 | 02.10.2020 | 10173 |

| 3 - 24 | 04.12.2023 | 04.12.2023 | 10971 |

| 7 | 07.06.2024 | 07.06.2024 | 11099 |

| Registration Date | 02.06.2006 |

| Registration Number | 222720 |

| Trade Registry Office | ANKARA |

| Mersis Number | 0735057469900001 |

| Registered Electronic Mail (KEP) Address | ronensansgayrimenkul@hs03.kep.tr |

| Tax Number | 7350574699 |

Click for KAP announcements.

10.03.2025 - Evaluation Report About the Assumptions Used in Public Offering Price Determination

25.02.2025 - Participation Finance Principles Information Form

24.02.2025 - Corporate Governance Compliance Report

24.02.2025 - Corporate Governance Information Form

24.02.2025 - Declaration of Liability

24.02.2025 - Financial Statement

24.02.2025 - Material Event Disclosure (General)

24.02.2025 - Operating Review (Consolidated)

24.02.2025 - Sustainability Compliance Report

24.02.2025 - Material Event Disclosure (General)

11.02.2025 - Change in Articles of Association

07.02.2025 - Notification Regarding Merger Process

05.02.2025 - Material Event Disclosure (General)

31.01.2025 - Corporate Governance Compliance Rating

24.01.2025 - Board of Directors' Subcommitees

31.12.2024 - Declaration of Liability

11.10.2024_Notification Regarding General Assembly Procedures

11.10.2024_Minutes of the Extraordinary General Assembly Meeting

18.09.2024_Notification Regarding General Assembly

18.09.2024_Announcement Document

18.09.2024_Other Invitation Document

18.09.2024_General Assembly Informing Document

18.09.2024_General Assembly Informing Document

18.09.2024_Other Invitation Document

27.08.2024_Report About the Use of the Fund Obtained or will be Obtained from Capital Increase

27.08.2024_Evaluation Report About the Assumptions Used in Public Offering Price Determination

20.08.2024_Participation Finance Principles Information Form

19.08.2024_Declaration of Liability

19.08.2024_Financial Statement

19.08.2024 - Financial Statement Disclosure

01.07.2024_Corporate Governance Information Form

28.06.2024_Evaluation Report About The Assumptions Used In Public Offering Price Determination

24.06.2024_Articles of Association

13.06.2024_Special Situation Disclosure (General)

13.06.2024_Share Trading Notification

11.06.2024_1Q24 Investor Presentation

11.06.2024_1Q24 Annual Report (Consolidated)

11.06.2024_Declaration of Liability (Consolidated)

11.06.2024_1Q24 Financial Statement Disclosure

11.06.2024_Articles of Association Update

11.06.2024_FY23 Financial Statement Disclosure

31.05.2024_Board of Directors_Appointment of Independent Board Members

31.05.2024_Company General Info Form

25.05.2024 Change in Articles of Association

25.05.2024_Determination of Independent Audit Company

25.05.2024 End of the Price Stability Process

24.05.2024_Participation Finance Principles Information Form

24.05.2024_Company General Info Form

22.04.2024_List of Investors Who Acquired More than 5% Share in the Public Offering of RGY

Rönesans Gayrimenkul Yatırım A.Ş. (RGY) was established in 2006..

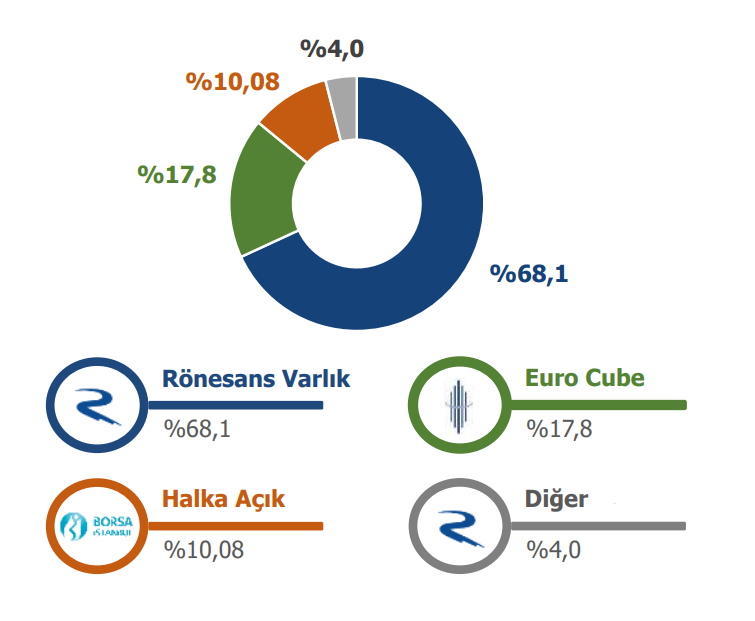

The shareholding structure of the company is as follows: Rönesans Holding with 68.12%, GIC with 17.80%, publicly traded share with 10.08% and other shareholders with 4%.

The current portfolio includes 20 real estate in total, consisting 12 shopping centers, 4 offices, 1 school that already operational and 1 ongoing residence project and 2 land plots available for future development.

Rönesans Gayrimenkul Yatırım A.Ş. started to be traded on the star market of Borsa Istanbul on 26 April 2024.

BIST ANKARA / BIST SERVICES / BIST YILDIZ / BIST 500 / BIST IPO / BIST ALL / BIST ALL-100

The capital size of Rönesans Gayrimenkul Yatırım A.Ş. has TL 331,000,000.

60-65% of the proceeds from the IPO are planned to be used for repayment of financial debt, 5-10% for repayment of non-trade payables to related parties, 15-20% for investments and 10-15% for working capital.

The sources of income of Rönesans Gayrimenkul Yatırım A.Ş. consist of rental income from the real estate portfolio, real estate sales income and income from financial assets.

The financial year of Rönesans Gayrimenkul Yatırım A.Ş. is a 12-month calendar year. (January - December)

The independent audit firm of Rönesans Gayrimenkul Yatırım A.Ş. is PwC Bağımsız Denetim ve Serbest Muhasebeci Mali Müşavirlik A.Ş. (A Member Firm of PricewaterhouseCoopers).

Investor Relations Department can be contacted by phone or e-mail for questions.

Telephone: +90 216 430 61 14

E-mail: investor.relations@rgy.com.tr

Rönesans Gayrimenkul Yatırım A.Ş. is not a REIT and therefore is not included in the BIST REIT index.

Maltepe Park Residence Project is ongoing. In addition, there is Ümraniye Land suitable for future project development and Beachtown Project in Konyaaltı, Antalya.

Financial information about the company is available under Investor Relations | Rönesans Gayrimenkul.

Appraisal reports related to the company are available under Investor Relations | Rönesans Gayrimenkul.